An employee travelled less than 12 000 business kilometres per annum. ÒsalaryÓ includes all pensionable emoluments.

The embassy warns citizens against the scam.

Traveling allowance meaning. This Act may be cited as the Travelling Allowances Act. ə l ɪkˌspensɪz us ˈtræv. Prior to 28 February 2018 there was no PAYE withholding requirement nor was this included in the employees taxable income for tax disclosure purposes where.

It usually takes care of things like accommodation food drink and transport. If you get it before you go dont feel like you have to spend all of it. It is a payment made to an employee to cover costs while travelling away from home overnight for work-related purposes.

SR 30Admitted to Shortest of two or more practical routes provided. An employee can be paid the allowance in advance or. Travel allowance - a sum allowed for travel.

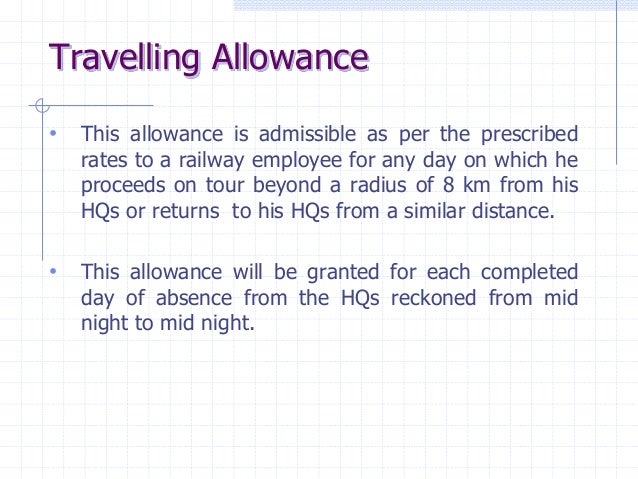

Travel allowance includes travel fare Train or Flight or Bus food accommodation and local expenses. Mileage - a travel allowance at a given rate per mile traveled. Meaning of travel allowance.

Switch to new thesaurus. Appearing in departmental examination interview or selection test conducted by. What Is the Basic Travel Allowance BTA.

Your employer may also choose to pay the actual expenses. Travel allowance is the payment made to an employee when employees travel for work to some other location. Every year the ATO releases a Tax Determination TD listing the reasonable amounts that can be paid as a travel allowance.

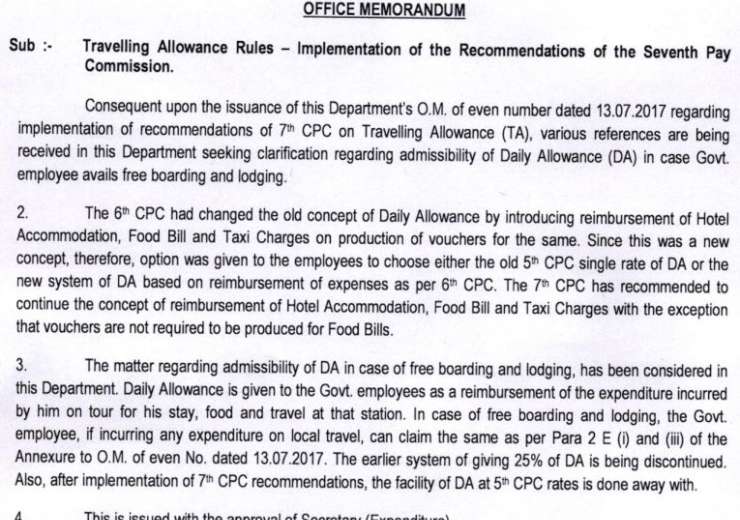

Travelling Allowance Rules - production. What does travel allowance mean. It covers within country travel cost when heshe is on leave from work.

Information and translations of travel allowance in the most comprehensive dictionary definitions resource on the web. According to the Embassy of the United States in London a Basic Travel Allowance refers to a scam under which foreign nationals request money from US. Related words and phrases.

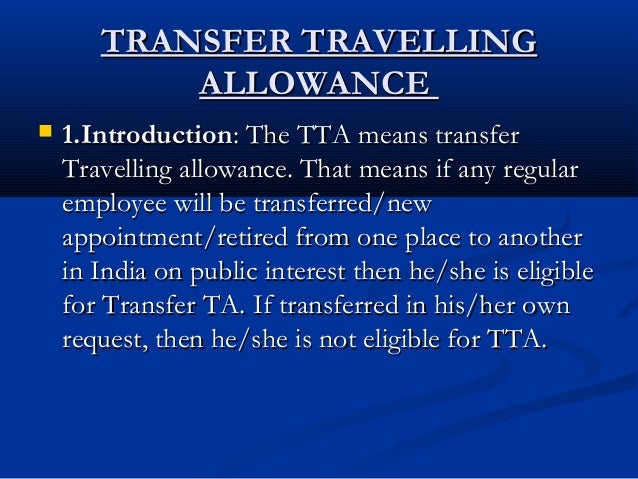

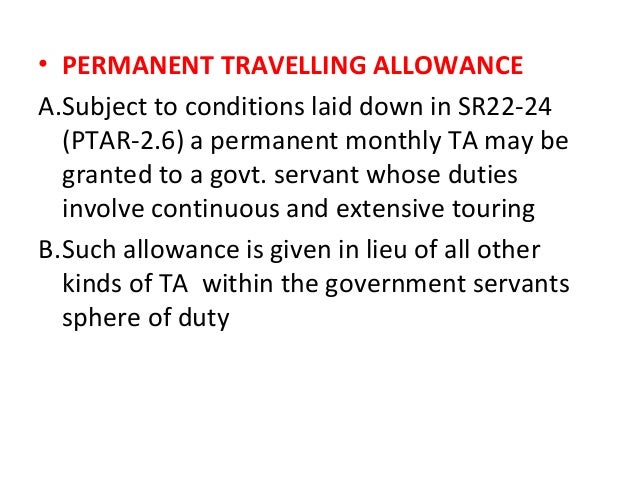

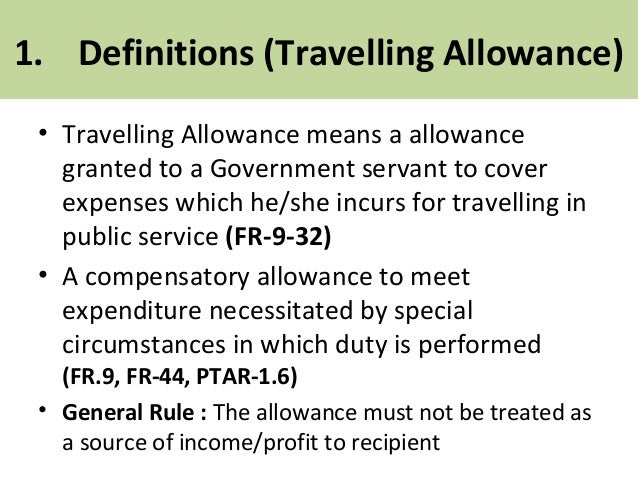

I Travelling Allowance is a kind of compensatory allowance granted to meet personal expenditure necessitated by the special circumstances in which duty is performed. If you are travelling by public transport in the Netherlands you may receive a travel allowance with a maximum of 019 per kilometer. 38 rows travelling allowance and related matters archives.

Citizens for travel to the United States claiming that a BTA is required under US. Section 105 of the Income Tax Act 1961 with Rule 2B ensures the exemption of tax and also details the conditions subject to. TRAVELLING ALLOWANCES ACT An Act relating to Travelling Allowances to Public Officers.

2 The maximum amount of money travellers are allowed to take out of a country under an exchange control system such as the Exchange Control Act of 1947 in the United Kingdom which was suspended in 1979 and repealed in 1987. Chapter - 17 Traveling Allowance Rules 240 40 TRAVELLING ALLOWANCE. You could receive your travel allowance before or after your business trip.

A reimbursive travel allowance is an allowance paid to an employee for actual business kilometres travelled. It includes allowance granted for the maintenance of conveyances horses and tents. A travel allowance is a payment from the company you work for to cover your expenses when you travel for work.

In this ActÑ ÒOfficerÓ includes every person temporarily or permanently employed in the public service of Trinidad and Tobago. 41 An employee will be eligible for travelling allowance if journeys are undertaken for the following purposes. 24 TH M ARCH 1914 1.

Allowance - a sum granted as reimbursement for expenses. Leave Travel Allowance or LTA is type of allowance given to the employee by employers for travel. Money that you are given regularly especially to pay for a particular thing.

Of the various types of Travelling Allowance Mileage Allowance as per SR 29 is an allowance calculated on the distance travelled which is given to meet the cost of particular journey. ə l ɪkˌspensɪz money that your employer pays you because you are spending that amount on travel that is necessary for your work SMART Vocabulary. Travelling Allowance means an allowance granted to a Government servant to cover the expenses which he incurs in travelling in the interests of public service.

Typically an allowance will cover accommodation or meals and incidentals or both. And expenses made by the employee for business travel or commuting with public transport may be reimbursed tax-free.

Leave Travel Allowance Lta Claim Rule Eligibility Tax Exemptions

7th Pay Commission Confused About Travelling Allowance Rules Here S What Govt Employees Must Know 7th News India Tv

What Is The Full Form Of Ta And Da Quora

What Is Conveyance Transport Allowance Amp How To Get Exemptions For It

How To Calculate A Travel Allowance Quora

0 comments:

Post a Comment